Using stock historical data, train a supervised learning algorithm with any combination of financial indicators. Rapidly backtest your model for accuracy and simulate investment portfolio performance.

pip install clairvoyantpython -m pip install git+https://github.com/anfederico/clairvoyantDuring the testing period, the model signals to buy or sell based on its prediction for price movement the following day. By putting your trading algorithm aside and testing for signal accuracy alone, you can rapidly build and test more reliable models.

from clairvoyant.engine import Backtest

import pandas as pd

features = ["EMA", "SSO"] # Financial indicators of choice

trainStart = 0 # Start of training period

trainEnd = 700 # End of training period

testStart = 701 # Start of testing period

testEnd = 1000 # End of testing period

buyThreshold = 0.65 # Confidence threshold for predicting buy (default = 0.65)

sellThreshold = 0.65 # Confidence threshold for predicting sell (default = 0.65)

continuedTraining = False # Continue training during testing period? (default = false)

# Initialize backtester

backtest = Backtest(features, trainStart, trainEnd, testStart, testEnd, buyThreshold, sellThreshold, continuedTraining)

# A little bit of pre-processing

data = pd.read_csv("SBUX.csv", date_parser=['date'])

data = data.round(3)

# Start backtesting and optionally modify SVC parameters

# Available paramaters can be found at: http://scikit-learn.org/stable/modules/generated/sklearn.svm.SVC.html

backtest.start(data, kernel='rbf', C=1, gamma=10)

backtest.conditions()

backtest.statistics()

backtest.visualize('SBUX')------------ Data Features ------------

X1: EMA

X2: SSO

---------------------------------------

----------- Model Arguments -----------

kernel: rbf

C: 1

gamma: 10

---------------------------------------

--------- Engine Conditions ----------

Training: 2013-03-01 -- 2015-12-09

Testing: 2015-12-10 -- 2017-02-17

Buy Threshold: 65.0%

Sell Threshold: 65.0%

Continued Training: False

---------------------------------------

------------- Statistics --------------

Total Buys: 170

Buy Accuracy: 68.24%

Total Sells: 54

Sell Accuracy: 59.3%

---------------------------------------

Once you've established your model can accurately predict price movement a day in advance, simulate a portfolio and test your performance with a particular stock. User defined trading logic lets you control the flow of your capital based on the model's confidence in its prediction and the following next day outcome.

def logic(account, today, prediction, confidence):

if prediction == 1:

Risk = 0.30

EntryPrice = today['close']

EntryCapital = account.BuyingPower*Risk

if EntryCapital >= 0:

account.EnterPosition('Long', EntryCapital, EntryPrice)

if prediction == -1:

ExitPrice = today['close']

for Position in account.Positions:

if Position.Type == 'Long':

account.ClosePosition(Position, 1.0, ExitPrice)

simulation = backtester.Simulation(features, trainStart, trainEnd, testStart, testEnd, buyThreshold, sellThreshold, continuedTraining)

simulation.start(data, 1000, logic, kernel='rbf', C=1, gamma=10)

simulation.statistics()

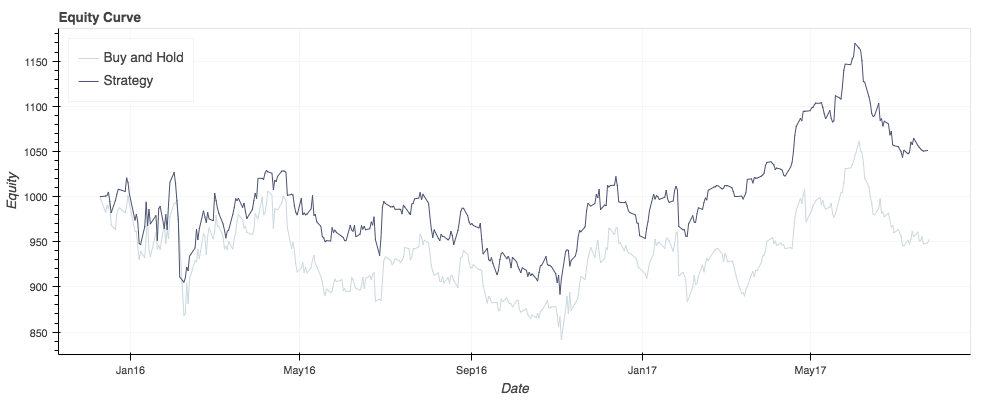

simulation.chart('SBUX')------------- Statistics --------------

Buy and Hold : -6.18%

Net Profit : -61.84

Strategy : 5.82%

Net Profit : 58.21

Longs : 182

Sells : 168

Shorts : 0

Covers : 0

--------------------

Total Trades : 350

---------------------------------------

The primary purpose of this project is to rapidly test datasets on machine learning algorithms (specifically Support Vector Machines). While the Simulation class allows for basic strategy testing, there are other projects more suited for that task. Once you've tested patterns within your data and simulated a basic strategy, I'd recommend taking your model to the next level with:

https://github.com/anfederico/gemini

The examples shown use data derived from a project where we are data mining social media and performing stock sentiment analysis. To get an idea of how we do that, please take a look at:

https://github.com/anfederico/stocktalk

Remember, more is not always better!

variables = ["SSO"] # 1 feature

variables = ["SSO", "SSC"] # 2 features

variables = ["SSO", "SSC", "RSI"] # 3 features

variables = ["SSO", "SSC", "RSI", ... , "Xn"] # n featuresPlease take a look at our contributing guidelines if you're interested in helping!

- Export model

- Support for multiple sklearn SVM models

- Visualization for models with more than 2 features